Protect The Future By Eliminating Taxes

You didn’t come this far to stop

SIMPLE PROTECTION

HELPING FAMILIES NATIONWIDE

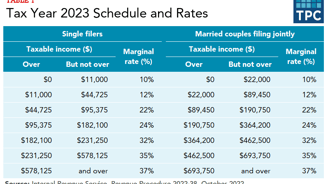

TAXES AREN'T GOING DOWN

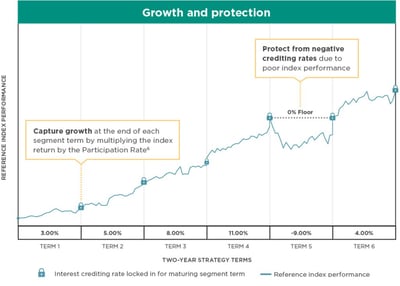

Indexed Universal Life (IUL) Policies:

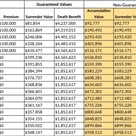

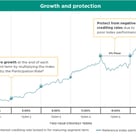

6%-8% Estimated Gains: IULs provide a tax-free investment with an average potential growth rate of 6% to 8%, offering significant gains over time.

Protection Against Losses: The IUL includes a floor cap at 0%, meaning no negative returns in down markets, and a ceiling cap at 11.5%, maximizing gains during favorable conditions.

TAX FREE vs. TAX DEFERRED

Tax-Deferred Accounts (401k, 403b):

4% Estimated Gain, but with High Fees: Tax-deferred products like 401k and 403b plans have a comparable estimated return of 4%. However, high fees (3%-4%) can significantly reduce the final value.

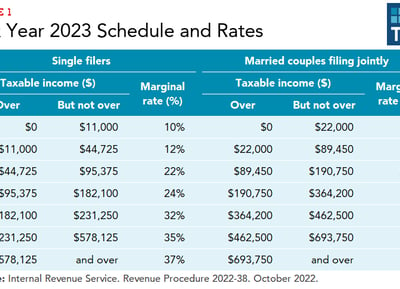

Impact of Taxes:

Historical Tax Trends: Taxes have historically been on the rise, and with current fiscal policies and future projections, they are likely to increase further.

Potential Retirement Costs: Withdrawals from tax-deferred accounts during retirement could face higher tax rates, significantly reducing the available funds compared to tax-free options like Roth IRAs or IULs.

Roth IRA:

4% Estimated Gain: Roth IRAs also offer tax-free growth with an estimated 4% return, providing a stable, predictable growth option.

POWERED BY

EQUIS FINANCIAL

Personalized Business Solutions

POTENTIAL AGENTS CLICK JOIN NOW

sheldonr.infinitebanking@gmail.com

(702) 931-7301

CONTACT US